- Medical

- Cancellations

- Delays

- Baggage and personal items

- Car hire

- Cruises

- Sports and activities

- Insolvency

Medical

This is the number one reason to buy international travel insurance. Look for the insurer’s benefits table, usually on the quotes screen online or near the front of their PDS, for a quick overview of what they’re offering. Most policies have an ‘unlimited’ sum insured.

Pre-existing conditions

Some insurers don’t cover pre-existing conditions at all. Some will only cover pre-existing conditions with an extra fee and sometimes a medical assessment. Some automatically cover pre-existing conditions listed in their PDS, although few will cover mental illnesses such as depression or anxiety.

Insurers exclude cover for certain pre-existing medical conditions and generally don’t provide cover for any illnesses or incidents that arise from these. This includes terminal illness or any illness that shortens your life expectancy as well as organ transplants.

Minor pre-existing medical conditions such as asthma, hypertension, diabetes, epilepsy, osteopenia and more are usually covered if:

- the condition has been stable for more than 12 months

- there is no planned surgery

- you have not received treatment in the past 12 months.

Examples of conditions that usually need to be assessed before getting cover are coronary problems, lung disease, epilepsy, stroke or any surgeries in the last 2 years.

If in doubt, declare your condition to your insurer.

Pre-existing condition spoiling your holiday plans?

- findaninsurer.com.au lists insurers that may provide cover for pre-existing conditions.

- Still having trouble finding cover? Enlist the help of an insurance broker.

Disability

A disability shouldn’t prevent you from buying travel insurance, but it might make finding a good policy trickier and more expensive.

Is a disability a pre-existing condition?

It depends on the disability and the insurer. Many insurers will automatically cover travellers with limited mobility, cognitive impairments or vision/hearing impairments. But in some cases, this cover may come at an extra cost.

Check with the insurer, as some conditions will need to be assessed on a case-by-case basis.

Having trouble getting cover?

Under the Disability Discrimination Act, insurers must assess the actual risks, rather than make assumptions about disabilities. If you’re having trouble getting insurance, a letter from a medical professional might help, particularly if they can state that you’re not likely to need medical or hospital treatment while on your trip.

Cover for your equipment

If you’re travelling with a wheelchair, mobility aid or hearing aid, you’ll need to insure that as well. Check single item limits, which are usually between $750 and $1,000 per item. If you have a piece of medical equipment that exceeds this, you’ll need to specify it and insure it separately.

Many insurance policies exclude hearing aids, so check the fine print and take out extra insurance if necessary.

Cover for your carer

If you’re travelling with a carer, it’s a good idea to be on the same policy in case travel plans change for either of you – that way you’re both covered. If you have a paid carer, ask your insurer whether they’ll cover the cost of a replacement carer should yours be unable to travel.

Pregnancy

If you’re travelling while pregnant, be sure to check the following.

- Are you covered for pregnancy complications? Some insurers don’t cover pregnancy at all.

- Up until which stage of pregnancy? Pregnancy complications are usually only covered up until a certain stage (often between 23 and 32 weeks, depending on the insurer).

- Childbirth: Not all insurers will cover childbirth. A premature birth in the US with intensive care and treatment could end up costing hundreds of thousands of dollars.

- IVF: Not all insurers will cover IVF pregnancies.

- Do you have to pay extra to be covered?

- Do you need medical approval to be covered?

Mental health

Many travel insurers won’t provide cover of any kind for hospitalisation, medication or missed travel caused by a mental health condition, whether that’s depression, anxiety or a psychotic episode.

Others will provide cover if you declare mental illness as a pre-existing condition and pay a higher premium. Check the PDS carefully; insurers may use different terms to describe the same mental health conditions, giving them wriggle room to deny a claim.

Insurers are highly unlikely to pay a mental health-related claim if they discover it was a pre-existing condition that you didn’t declare. The trouble is, an insurer might view a single visit to a therapist many years ago because of work stress, for example, as a pre-existing mental health condition.

Mental health and travel insurance have been a contentious issue for consumer rights groups including CHOICE – and it’s one that’s still evolving from a legal standpoint.

To find out if a travel insurance product includes mental health cover, check choice.com.au/travelinsurance, filtering for ‘mental illness related claims.’ Then put the PDS under the microscope.

Age limits

Most policies have an age limit, ranging right up to the 100-year-old seasoned adventurer. There are quite a few catches for older travellers, though.

- Higher premiums: Insurers often charge older travellers more, and in some cases ‘older’ can be as young as 50.

- Higher excess: Travellers as young as 60 but more commonly over 80 may be subject to a higher excess because of their age. The normal excess of around $100 to $200 is often increased to an excess of $2,000 to $3,000 for travellers 80 years and over for claims that relate to injury or illness.

- Restricted conditions: Subject to medical assessment’, ‘reduced medical cover limits’, ‘reduced travel time’, ‘policy to be purchased 6 months in advance’ – all of these conditions can apply to travellers over a certain age.

Case study - Medical claims

A woman in Victoria won a court case against her insurer after they declined her claim for the cancellation of an overseas trip due to depression. "We took out the travel insurance well in advance of the travel, and well before my depression. I was certainly under the impression that I was covered," she told CHOICE. "They just sent back a letter that said no." But her win (the Victorian Civil and Administrative Tribunal awarded her $4,292 for economic loss and a further $15,000 for non-economic loss) was an isolated ruling. It’s still being debated whether or not a general exclusion for mental health claims is legal.

Cancellations

You’ll probably want to be covered if your travel plans are cancelled for any reason, but be aware that insurers will come up with plenty of excuses to avoid paying up.

- Terrorism: Most insurers cover medical expenses but very few cover cancellation expenses in the event of terrorism.

- Pandemic or epidemic: Commonly excluded.

- Military action: Commonly excluded.

- Natural disaster: Covered more often than not.

- Travel provider/agent insolvency: Commonly excluded.

- Cancellation due to travel provider’s fault: Insurers commonly exclude cover for delays or rescheduling caused by the transport provider.

‘Unforeseen’

When an insurer refers to cover for ‘unforeseen circumstances’, it means something that wasn’t publicised in the media or official government websites when you bought the policy. Check the Smartraveller travel advice when you buy your travel insurance. If an event became known before you bought the policy, you’re not covered. So the earlier you buy travel insurance, the more likely you are to be covered for the unexpected.

Travel insurance and Smartraveller advice

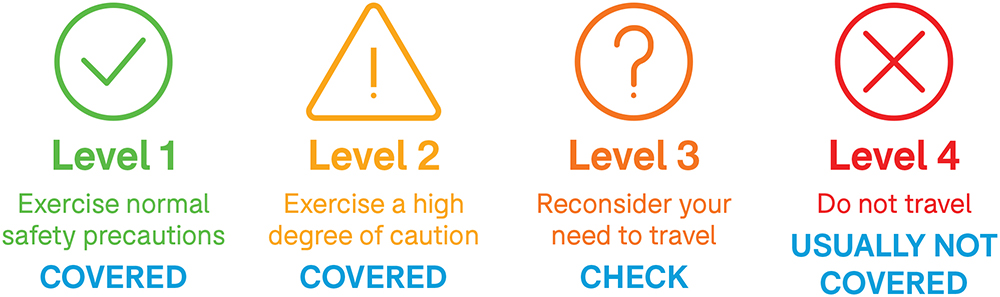

Smartraveller, managed by the Department of Foreign Affairs and Trade (DFAT), assigns an overall advice level to more than 175 destinations. This advice level can affect your travel insurance cover. The advice levels are:

- Level 1 – Exercise normal safety precautions. COVERED.

- Level 2 – Exercise a high degree of caution. COVERED.

- Level 3 – Reconsider your need to travel. CHECK.

- Level 4 – Do not travel. USUALLY NOT COVERED.

Travel warnings can work in your favour. If an insurer excludes cover for an event, they may still cover you to change your plans in response to updated advice from Smartraveller.

But beware when travelling to a destination that has a ‘Do not travel’ warning. Most standard policies won’t cover you for ‘Do not travel’ destinations.

Exclusions and inclusions

When the Australian Financial Complaints Authority (AFCA) looks at a complaint about an insurer, they expect you to prove the claim is covered by the policy, while the insurer must prove the claim is excluded by the policy. Specifically, AFCA expects you to ‘establish on the balance of probabilities that you suffered a loss caused by an event to which the policy responds’. That is, do you have a valid claim?

This means that you need to understand if your claim is covered under the listed events of the policy, or that it is not specifically excluded by the policy.

Case studies - Cancellations

John* and his partner’s scheduled train service was delayed, seriously diverted, then terminated, which meant they missed their flight home by several hours. Re-booking fees, emergency accommodation and related fees cost them between $1,000 and $1,500, but the insurer wouldn’t pay the claim as trip interruption wasn’t in the policy.

Michael* had to cancel his trip when his father in Spain suddenly died. The insurance policy covered expenses to cancel a trip and return home to a sick relative. Unfortunately, it only covered this if the relative lived in Australia. Michael’s claim for cancellation expenses was declined.

A week after a volcanic eruption made world news, Sameer* booked a trip to Bali. He assumed the emergency would be over by the time he was due to fly a month later. Unfortunately, the volcano continued to erupt and Sameer’s flight was cancelled. His insurer declined his claim because he’d bought the flight and insurance after Smartraveller issued a travel alert about the volcanic eruption, and after it had been in the news.

*To protect privacy we have changed names and some details

Delays

Delays can be expensive, particularly if you have to pay for alternative transport or accommodation. And those extra expenses won’t always be covered.

- Transport delay is only covered after a certain number of hours, usually 6, but you may have to wait as long as 12 hours before your cover kicks in.

- Cover limits for transport delays are typically lower than other cover limits and are often limited per 24-hour period.

- Insurers often exclude cover for rescheduling caused by the transport provider but some may cover additional accommodation and travel expenses in this scenario for travellers who are en route.

Baggage and personal items

Baggage cover varies widely, with travel insurance policies ranging from $0 to $30,000. So, if you’re not carrying expensive items, you may be able to save on your premium by selecting a policy that provides lower coverage.

- Individual items are subject to sub-limits that range from around $250 to as much as $5,000.

- Higher item limits usually apply for electronic items like laptops, cameras, smartphones and tablets.

- You can pay extra to specify items you want extra cover for (insurers are always happy for you to pay extra).

- Valuables locked in a car or checked in on an airline, train or bus may not be covered.

- Generally, any items left unattended may be excluded from cover, so keep your belongings close.

Lost luggage

If an airline loses your luggage temporarily and doesn’t compensate you for that loss, you may be able to claim expenses for clothing, toiletries and other necessities, depending on your policy.

- Cover usually only applies to luggage lost for more than 12 hours, though the minimum time limit varies per insurer, as does the level of cover.

- If your policy has an excess (a fee that’s deductible from your payout), remember that this applies once per claimed event, and items below the excess level can’t be claimed.

Case studies - Baggage and personal items

Jing* sat down to try on a pair of shoes in a busy London shoe shop, placing her handbag next to her on the seat. When she stood up to leave, she discovered her bag was gone. Her insurer refused to pay up because she had left her bag unattended in a public place.

Angelo and Diane* tried to claim $112 for meals and drinks when their connecting flight to Hawaii was delayed by 8 hours. Although their policy technically covered them for the cost, they were liable for an excess of $250, so their claim was denied.

*To protect privacy we have changed names and some details

Car hire

If you don’t feel like paying the ‘extra insurance’ the car hire company charges, then use the collision damage excess cover in your travel insurance.

Tip: Stick with recognised car rental companies in this case since this cover only applies if the car hire company already has its own comprehensive insurance.

Do you have the right licence?

Some countries require you to have an international driving permit. If you have an accident while driving on the wrong licence (or breaking that country’s law in any other way), you may not be covered.

Cruises

Cruise-specific insurance

Cruises aren’t automatically included in all travel insurance policies. If you’re going on a cruise, make sure you have the right cover.

Cruise ships carry a higher risk for spreading disease compared to other non-essential activities and transport modes. COVID-19, influenza and other infectious diseases such as gastroenteritis spread easily between people living and socialising in close quarters.

Check travel insurance policies to make sure medical cover for COVID-19 is included, as some policies exclude this cover.

Not leaving Australian waters?

You still need insurance. Doctors working on cruise ships don’t need Medicare provider numbers, so if they treat you, you can’t claim on Medicare or your private health insurance, even if you’re still in Australian waters.

Domestic travel insurance doesn’t cover medical costs, so you need either international travel insurance (check that it covers domestic cruises) or a domestic cruise policy.

Case studies - Cruises

Erica* stumbled and broke her femur during stormy seas while on a cruise. Her insurer covered the cost of evacuation and a partial hip replacement at a hospital in Noumea. They also organised and paid for her son to fly to Noumea to help her recover and return home to Australia. Five months later, the well-travelled 82-year-old was boarding a plane to Croatia for her next (fully insured) adventure.

Kerry* thought she’d done the right thing buying an annual multi-trip international travel insurance policy for a number of upcoming holidays, one of which was a round-trip cruise departing from and returning to Fremantle, Western Australia, with no port stops. When she had to cancel due to ill health, she discovered her policy wouldn’t cover her because the trip wasn’t considered an international one.

*To protect privacy we have changed names and some details

Sports and activities

When CHOICE compares travel insurers, we look at who covers which sports and adventure activities, such as skiing, ballooning, bungee jumping and scuba diving, to name a few.

But as always with insurance, the PDS may include some surprises. For example, several insurers we’ve reviewed will cover canyoning but they won’t cover abseiling, often a necessity in canyoning. Other policies in our comparison will cover abseiling, but not into a canyon.

If you’re planning on doing anything adventurous, check to make sure you’re covered. It’s not enough to simply look for the tick next to your chosen activity – you also need to check the definitions in the PDS.

Motorcycles and mopeds

Hiring a motorcycle or moped? Depending on which country you’re in, you might need a local or international motorcycle licence. You probably won’t be covered if you aren’t obeying the local law. And even if you are doing the right thing under local law, some policies still won’t cover you unless you have a motorcycle licence.

Are you wearing a helmet? Most countries say you need one by law, but that doesn’t mean it will be included in your hire. No helmet means no cover (in more ways than one).

Skiing and snowboarding

Some insurers cover skiing, often for an extra premium, but not so many cover skiing off-piste (away from the groomed runs). So, if you’re tempted to slide off the beaten path next time you hit the slopes, make sure you have a policy that covers off-piste ski runs (or pay for the optional extra cover).

Otherwise, if you run into a tree and have to be evacuated from the mountains, you may need to think about selling your home to pay for it.

It’s worth remembering that travel insurance only covers overseas costs. So if you break a leg while you’re abroad, your insurer will likely pay your hospital fees, but they won’t cover your ongoing physiotherapy once you’re back home.

Alcohol and drugs

Overdoing it on vodka and float-tubing down a river isn’t likely to be covered by any policy. Insurers simply won’t pay for costs arising from you being under the influence of alcohol or drugs (except where taken under the advice of a doctor).

Even one or 2 drinks could be enough of an excuse for insurers to get out of paying.

Case studies - Sports and activities

Nhung* was injured after she rented a moped in Thailand only to find out the engine size was not covered by her insurance policy. Most insurers adopt the national standard for the definition of a moped – an engine capacity under 50cc. If the engine is bigger than that, it’s a motorcycle and you’ll need an Australian motorcycle licence.

Marianna* fractured her leg in 3 places while skiing with her partner and children in Japan. Because the family had bought additional cover for winter sports, they were reimbursed $35,466 for medical expenses, additional transport and accommodation, the cost of a nanny to look after the children, and business class flights back to Australia.

*To protect privacy we have changed names and some details

Insolvency

“Only one quarter of policies in the CHOICE travel insurance comparison cover insolvency”

So you’ve booked and paid for your holiday through a travel agent, but then the travel agent goes broke. You’ll get your money back, right? Not necessarily.

Only a few insurers will cover you for the insolvency of a travel provider, and that includes hotels, airlines and other transport companies that might go broke overnight (remember Ansett?). But there are a few ways to safeguard your hard-earned holiday.

- Check whether your insurer covers you for insolvency.

- Check whether your travel agent has insolvency insurance (this isn’t compulsory, so only some will have it).

- Pay with your credit card. Some banks allow a chargeback if you pay for something on your credit card and don’t end up actually getting it.

Tip: Don’t accept any dodgy contract terms that require you to give up your chargeback rights.

Relatives can be relative

Many policies cover the costs to travel home if one of your relatives dies or becomes sick. Bear in mind:

- an insurer’s definition of a ‘relative’ may differ from yours

- cover is usually dependent on the age of that relative, so the death of your 84-year-old grandma may not be covered

- your relatives are subject to the same pre-existing condition exclusions as you, so if your 84-year-old grandma died from a known heart condition, you may not be covered.

- you may be able to apply for your relative’s pre-existing condition to be assessed before you buy the policy.

- cover is limited to relatives that live in Australia, or in some cases New Zealand. So if your 84-year-old grandma is in China, you won’t be covered to fly there for her funeral.

Case study

Amanda* and her husband had booked an overseas diving trip, but shortly before the trip Amanda’s mum passed away from pneumonia. They cancelled their trip and incurred cancellation costs and lost deposits of nearly $13,000. As the death of a parent was covered in their policy, Amanda made a claim. Their insurer denied the claim as Amanda’s mum lived in the United States and was undergoing treatment for lung cancer, so the insurer concluded that her death was caused by a pre-existing condition.

*To protect privacy we have changed names and some details