About that fine print

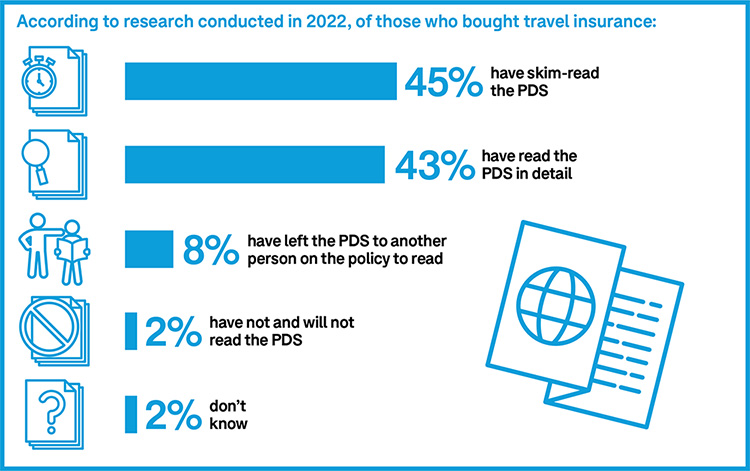

You’re about to click ‘buy’, so you may as well just tick this ‘I acknowledge I’ve read the product disclosure statement’ checkbox and bon voyage…

But wait – have you checked the fine print? In the insurance world, that ‘fine print’ is contained in the product disclosure statement, or PDS (that thing you said you’d read).

How to read the PDS

There are hundreds of policies out there and if you tried to read all the paperwork that comes with each policy, you’d have to extend your holiday just to recover.

If you don’t have time to read the whole PDS cover to cover, at least look for the following.

- The table of benefits is an overall summary of your cover.

- The policy cover section is essential reading and is generally split into ‘what we will pay for’ and ‘what we won’t pay for’.

- General exclusions are also essential reading – these are events that aren’t covered by any section of the policy.

- Pre-existing conditions can remind you of forgotten ailments and are essential reading for anyone with any kind of medical condition, no matter how mild.

- The word definition table might contain a few surprises – it’s a good place to check on the definition of a ‘relative’ or a ‘moped’, for example.

- The claims section lists some further pointers to be aware of (e.g. it’s a good idea not to admit fault or liability in the case of an accident) and the paperwork you may need to collect while you’re away if you need to make a claim, such as police reports.

- COVID-19 cover section – many policies have a special section listing medical, cancellation and other cover available for COVID-19.

- The 24-hour emergency assistance contact number (write it down and keep it handy).

Example

The Weaver* family was relieved to have travel insurance when they needed to cancel their holiday. The family wanted to go skiing in New Zealand, but a few days before they were due to depart, 12-year-old Ruby had cold symptoms. A COVID-19 test showed she was positive. Ruby and her whole family had to isolate and their travel insurance paid their cancellation costs.

*This is a fictitious but realistic example

The list of travel insurance disputes taken to the Australian Financial Complaints Authority (AFCA) reveals a battlefield of unread or misinterpreted terms and conditions. Between 1 July 2023 and 30 June 2024, AFCA received 2,054 travel insurance complaints.

Not all travel insurance policies are the same, and the wrong policy can be almost as bad as none at all.

Case study

Katherine’s luggage was stolen from the designated cargo section on board a bus in Barcelona. The insurer declined her claim for 2,500 Euro in losses (over $4,000).

According to the insurer, Katherine should have had the bag on her lap, or stood beside the bag in the cargo section of the bus, instead of leaving it ‘unattended’.

AFCA ruled in Katherine’s favour, saying it “was not reasonably possible for the complainant to avoid leaving her bag unattended in the circumstances.”